SERVICES

Due Diligence & Integration Services

for Private Equity & Family Offices

Protect your investment and unlock growth faster with operational due diligence and seamless integration support built for private equity and family office success.

The Problem:

Private equity firms and family offices face high risks during acquisitions—due diligence is complex, post-acquisition integration is chaotic, and operational inefficiencies often derail expected returns. Many firms lack the operational expertise needed to seamlessly transition newly acquired companies into their portfolio.

What We Offer:

We provide deep-dive due diligence and post-acquisition integration services to ensure PE firms and family offices maximize value from their investments. We help identify risks, streamline operations, and implement systems for growth in newly acquired companies.

We support PE firms by:

✔️ Conducting operational due diligence to uncover risks and opportunities

✔️ Building and executing post-acquisition integration plans

✔️ Aligning leadership teams for faster, smoother transitions

✔️ Implementing scalable processes to drive value creation

De-risk acquisitions and accelerate growth with our proven integration expertise.

Why Nspire2Gro?

Let’s talk about how we can help you scale, integrate, and optimize your business for long-term success.

Real-World Expertise

We’ve helped businesses scale, streamline operations, and drive profitability across multiple industries.

Flexible Engagement Models

Whether you need a fractional executive, a structured operating system, or full-scale system integration, we customize solutions to your needs.

Execution-Focused Approach

We don’t just consult; we help you implement, execute, and drive real results.

MEET RICHARD LANE

Richard Lane, our Founder and Principal Consultant, has more than 30 years of experience founding and operating technology-enabled service businesses. He is deeply passionate about leadership and helping organizations build high-powered cross-functional teams.

Richard works alongside CEOs, operating partners, and prviate equity firms to support the due diligence and the integration of acquired businesses.

- 3+ decades of operating experience in privately held companies

- Been involved in multiple exits and acquisitions of over 20 businesses as an operator.

- Expertise in technology-enabled B2B service companies

- Deep experience in technology systems development, integration, and implementation

- Broad vertical market experience – software, manufacturing, healthcare, education, legal services and real estate

Plus…

- Strategic planning, budgeting, financial reporting & analysis

- Acquisitions – due diligence and integration

- Managing Sales & Marketing Organization

10+ YEARS OF EXPERIENCE SELF-IMPLEMENTING BUSINESS OPERATING SYSTEMS

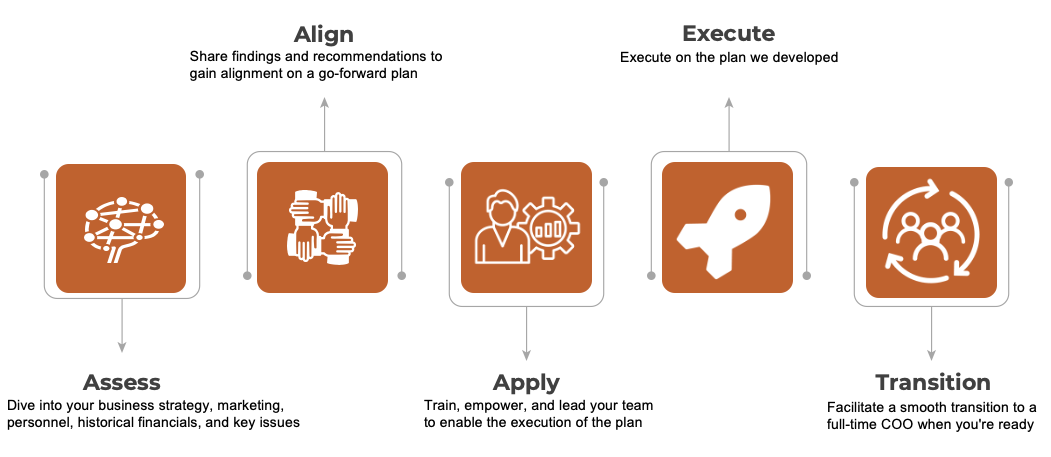

HOW WE WORK